Checking Out the Perks and Threats of Purchasing Cryptocurrencies

The landscape of copyright financial investment is identified by a complex interplay of compelling advantages and significant dangers. As we even more check out the subtleties of copyright investment, it comes to be obvious that educated decision-making is paramount; nevertheless, the concern continues to be: Exactly how can financiers effectively balance these benefits and risks to protect their monetary futures?

Recognizing copyright Fundamentals

As the electronic landscape develops, understanding the basics of copyright becomes vital for prospective investors. copyright is a type of electronic or online currency that utilizes cryptography for security, making it challenging to copyright or double-spend. The decentralized nature of cryptocurrencies, commonly built on blockchain innovation, improves their protection and openness, as deals are tape-recorded across a distributed journal.

Bitcoin, developed in 2009, is the initial and most well-known copyright, however hundreds of alternatives, called altcoins, have actually emerged considering that then, each with unique features and functions. Investors need to familiarize themselves with crucial concepts, including pocketbooks, which keep exclusive and public keys needed for purchases, and exchanges, where cryptocurrencies can be purchased, offered, or traded.

Furthermore, comprehending the volatility related to copyright markets is critical, as rates can fluctuate substantially within brief periods. Governing considerations likewise play a significant role, as various countries have varying stances on copyright, influencing its usage and acceptance. By realizing these foundational elements, potential financiers can make enlightened choices as they navigate the complex world of cryptocurrencies.

Key Benefits of copyright Investment

Spending in cryptocurrencies uses numerous engaging benefits that can attract both novice and skilled capitalists alike. One of the primary benefits is the potential for considerable returns. Historically, cryptocurrencies have actually exhibited remarkable price gratitude, with very early adopters of assets like Bitcoin and Ethereum recognizing considerable gains.

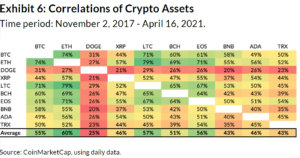

An additional secret benefit is the diversity chance that cryptocurrencies supply. As a non-correlated possession class, cryptocurrencies can function as a bush against conventional market volatility, enabling investors to spread their risks across numerous financial investment automobiles. This diversity can improve general portfolio efficiency.

In addition, the decentralized nature of cryptocurrencies supplies a degree of autonomy and control over one's assets that is typically lacking in conventional finance. Capitalists can handle their holdings without intermediaries, possibly lowering charges and enhancing openness.

Furthermore, the growing acceptance of cryptocurrencies in mainstream financing and business further strengthens their value suggestion. Several organizations currently accept copyright payments, leading the way for more comprehensive fostering.

Lastly, the technological technology underlying cryptocurrencies, such as blockchain, offers chances for investment in emerging fields, including decentralized finance (DeFi) and non-fungible symbols (NFTs), enriching the investment landscape.

Major Threats to Consider

An additional important risk is regulative uncertainty. Governments worldwide are still formulating plans regarding cryptocurrencies, and modifications in laws can considerably influence market dynamics - order cryptocurrencies. An undesirable governing environment might limit trading and even result in the outlawing of certain cryptocurrencies

Security threats likewise posture a significant risk. Unlike typical financial systems, cryptocurrencies are vulnerable to hacking and scams. Capitalist losses can take place if exchanges are hacked or if exclusive secrets are jeopardized.

Last but not least, the absence of consumer protections in click here for more the copyright space can leave financiers at risk - order cryptocurrencies. With minimal recourse in case of scams or theft, people might locate it testing to recover shed funds

In light of these risks, comprehensive research and danger analysis are essential prior to taking part in copyright investments.

Methods for Effective Investing

Establishing a robust strategy is vital for browsing the intricacies of copyright financial investment. Capitalists must start by carrying out extensive study to recognize the underlying innovations and market dynamics of numerous cryptocurrencies. This includes remaining notified about fads, regulative developments, index and market view, which can substantially influence property performance.

Diversity is one more key approach. By spreading financial investments across multiple cryptocurrencies, investors can reduce dangers associated with volatility in any kind of single property. A well-balanced profile can provide a barrier versus market changes while boosting the capacity for returns.

Establishing clear investment objectives is essential - order cryptocurrencies. Whether intending for short-term gains or long-lasting wide range accumulation, specifying certain purposes helps in making notified choices. Executing stop-loss orders can additionally protect investments from substantial recessions, enabling a self-displined departure strategy

Last but not least, constant surveillance and reassessment of the financial investment technique is essential. The copyright landscape is dynamic, and consistently evaluating performance versus market conditions makes certain that capitalists stay dexterous and receptive. By adhering to these strategies, investors can improve their possibilities of success in the ever-evolving globe of copyright.

Future Trends in copyright

As capitalists improve their approaches, recognizing future patterns in copyright ends up being increasingly important. The landscape of electronic money is developing rapidly, affected by technological advancements, governing growths, and moving market dynamics.

An additional arising trend is the expanding institutional rate of interest in cryptocurrencies. As business and banks adopt electronic currencies, mainstream approval is most likely to enhance, possibly causing higher rate security and liquidity. Furthermore, the integration of blockchain modern technology into numerous markets hints at a future where site here cryptocurrencies offer as a backbone for purchases across fields.

Furthermore, the regulatory landscape is progressing, with governments looking for to create structures that balance advancement and consumer security. This governing clearness could cultivate a more secure investment atmosphere. Lastly, improvements in scalability and energy-efficient consensus systems will certainly deal with problems surrounding transaction rate and ecological influence, making cryptocurrencies extra viable for daily use. Recognizing these trends will be important for investors wanting to browse the complexities of the copyright market efficiently.

Conclusion